- Home

- About Us

- Membership

- Events

- Conference

- Sponsors

- Resource Center

|

Welcome to the LACGP Newsletter. This e-newsletter is sent out on a monthly basis. The newsletter provides links to this page. Please see below for the items that appeared in the November 2022 issue. Staying the Course: Planned Giving in Uncertain Times Crystal Thompkins, CAP®, CSPGCM, Head of Philanthropic Solutions, BNY Mellon David Hohler, CFA, Director of Investments, Planned Giving, BNY Mellon One of the underlying factors impacting the financial markets is uncertainty, and that uncertainty can lead to impulsive actions that have unfortunate outcomes. The same holds true for planned giving — both in terms of cultivating planned gifts and investing planned gift assets. Planned gifts are designed to have a future charitable benefit and, generally speaking, have a long-time horizon. Making decisions in times of uncertainty without considering the long-term implications cannot only have negative financial consequences but can also result in donors' loss of faith in your organization's ability to support its mission. To help mitigate these risks, it is important for nonprofit organizations to monitor and maintain focus on the long-term goals for planned gifts. The following steps can help ensure sound stewardship and perhaps turn uncertainty into opportunities: Review risk tolerance, but maintain a long-term perspective. After significant market events, it is natural for investors to reassess their appetite for and ability to accept risk. When doing this, it’s important to remember that generally the most successful investors maintain discipline and look for opportunities when faced with challenging conditions. History has shown that financial markets recover more quickly than the “real” economy, and that missing just a few days during these recovery periods can have a long-lasting impact on investor returns. Now more than ever, it is critical for investors to realistically assess their risk tolerance and rebalance to the appropriate level of market exposure in their portfolios. Analyze gift projections and monitor recent gifts. Gift timing can be a huge factor in the success of a charitable gift annuity (CGA) or charitable remainder annuity trust (CRAT) due to the fixed payout amount. Recently funded, new gifts may have a hurdle to overcome from the decline in value so soon after funding. However, older and deferred CGAs and CRATs that had the benefit of significant market appreciation may not be as problematic. Monitor the values of these newer gifts more closely and remember the context when measuring the success of your overall program. Review required CGA state reserves to ensure adequacy. During periods of market volatility, it is important to review and monitor the adequacy of state reserves more frequently to ensure they are sufficient to meet state requirements. Like all investments, reserve assets are subject to market risk. A combination of poor market returns and increasing effective payouts can quickly exhaust excess reserve assets. A shortfall in reserve assets may necessitate the use of operating or other assets to support the gift annuity pool, at a time when these financial resources are most needed to support mission-related activities. Understanding all of the liquidity needs of your gift annuity pool will help to avoid the regulatory and reputational risks of a reserve shortfall. Clearly define achievable, long-term investment objectives. With an increase in the expected rate of inflation to 3% and fees of 0.5% to 1.0%, a planned giving vehicle with a 5% payout has a hurdle rate of approximately 9%. Based on our 2022 CMAs, we do not expect any portfolio or asset class to generate this level of return over the next 10 years. If growth of principal over time is not achievable, then not-for-profits must clearly define the objectives that are achievable for their organization and their donors. For example, the primary investment objective for a planned giving portfolio could be to fund the annual beneficiary distributions or to achieve a total return of inflation plus 4%, rather than real growth of the original gift amount. By setting reasonable expectations, organizations can better inform stakeholders and donors about the potential outcomes of a planned gift. Focus on long-term gift planning growth strategies while adjusting tactically for the short term. Staying focused on long-term strategies and goals in growing planned gifts will serve your organization, donors and mission in the long run. React and adjust to the changes in the current environment (e.g., finding new ways to steward donors from a distance), but avoid overreaction that will impact your mission in the future. For example, although it may seem counterintuitive, it’s important to continue cultivating new CGAs now to ensure a diverse pool of annuitants to mitigate risk, and to provide a healthy asset base that can help to support the pool during challenging financial times. Provide options for donors to support your mission. Market volatility and economic uncertainty may make donors hesitant to give now; however, donors may be more willing to consider an opportunity to fund a planned gift for future benefit. Testamentary charitable remainder trusts (CRTs) and flexible/deferred CGAs are valuable tools for locking in a gift now for future benefit to the charity and beneficiaries. Shifting priorities to meet immediate needs is often required in uncertain times. However, it is important that your organization’s long-term fundraising strategy for planned gifts isn’t neglected, or it may be difficult to recover after a crisis subsides. Prioritize reviewing and reassessing your planned giving strategy and goals based on adherence to your mission, not in response to current events. It’s also important to continue to communicate those goals to your supporters to keep them engaged and reassured that your organization remains mission-focused. Update from Bill Littlejohn of Sharp HealthCare Bill Littlejohn of Sharp HealthCare shares the organization’s progress as the team continues to build out their planned giving program. LACGP is proud to recognize the Sharp HealthCare Foundation not only for its outstanding work in the area of gift planning but to share in its results after five years of strategic planning and execution. Bill Littlejohn, CEO and Senior VP of the Sharp HealthCare Foundation, shares his findings with the LACGP Community in the summary below: Philanthropy at Sharp HealthCare

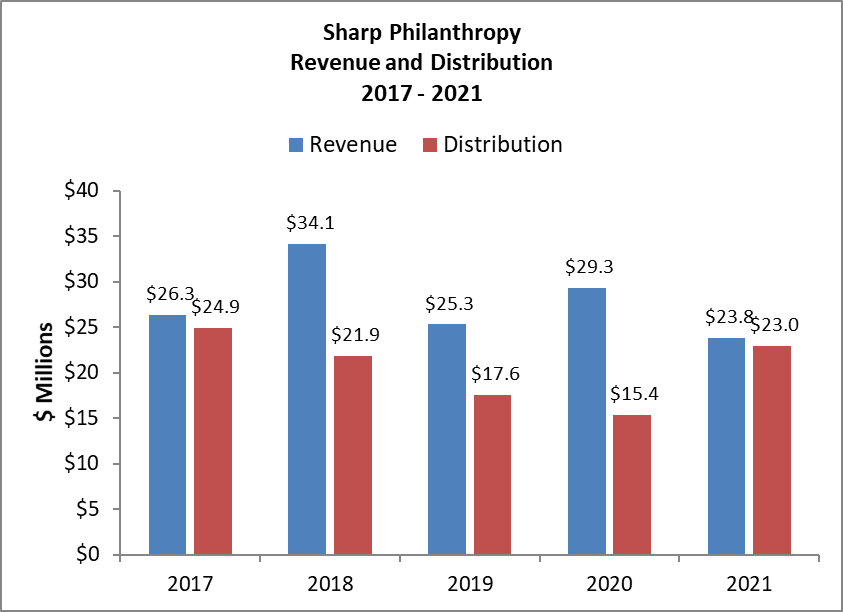

Sharp Philanthropy Performance For the last eight years, Sharp has achieved “High Performer” status among respondents for the Association for Healthcare Philanthropy (AHP) Report on Giving. AHP recognizes high performance based on net production returns in the top 75th percentile. The Sharp philanthropy program incorporates both strategic and annual planning, including projections for both revenue and distributions for capital and operating initiatives across the system. In the five-years ended September 30, 2021, the Foundations generated $138,856,968 in production revenues and distributed $102,669,760 in cash to the system.

The Sharp Foundations have the ability to solicit, negotiate and receive complex gifts, including charitable gift annuities, testamentary gifts and pledges; all forms of real estate, and one of our most successful deferred gift arrangements, the Life Estate Gift Annuity (LEGA). A Life Estate Gift Annuity is a gift arrangement that allows a donor to give a gift of his or her home to the Foundation today while continuing to live in and enjoy it. Specifically, a donor makes a gift of a "remainder interest" in his or her personal residence and retains a "life estate" in the property. In conjunction with this gift, the donor enters into a Gift Annuity Agreement with Sharp HealthCare Foundation, which provides the donor with a lifetime annuity. SHF has facilitated nearly three dozen retained life and LEGA transactions. Sharp HealthCare Foundation has established a $25 million Line of Credit with Sharp HealthCare to enable the Foundation the ability to enter into LEGA arrangements. Due to the nature of these transactions, there is no immediate cash, and the Foundation must utilize other funds in order to guarantee the annuity payments under State of California requirements. The Major Gift Team The Major Gifts Team, led by VP Beth Morgante incorporates Major Gift and Campaigns (Entities, Initiatives), Planned Giving, Grants, Corporate Partners, Prospect Research and Pipeline Tracking for Major Gifts, Stewardship, Legacy Circle and Pillars of Philanthropy. The team totals approximately 12.5 FTEs, with 1.5 FTEs dedicated planned gift officers. The major gift team endeavors to make more than 300 solicitations for gifts of $10,000 or more – individual major gifts, planned gifts, grants and corporate partnerships. The concept of the major gift team is that everyone works together to implement the maximum solicitation dynamic, with specific individual and team performance objectives, collaboration, sharing credit and diligent Moves Management. Members of the major gift team meet every Monday morning to discuss weekly activities and the entire team meets monthly to review dashboards and performance metrics and Moves management data, as well as in-service on major and planned gift strategy. The Foundations conduct daily wealth screening of hospital patients and the senior research analyst provides lists of identified or qualified prospects to the major gift team on an ongoing. In addition, the Foundations have a grateful patient order set in the Cerner electronic health record for physicians and other clinical leaders to provide referrals to the team. The following are the individual major gift officer annual performance objectives (these objectives can include planned gifts):

Planned Giving Goals and Performance: The goals of the Sharp Planned Giving Program plan are to:

The following is the planned gift performance for the last three years (Sharp only records irrevocable planned gifts with an actual value; revocable gifts are recorded in a table of expectancies). FY 2020 FY 2021 FY 2022 FY 2022 Dashboard (through 11 months) Giving Societies To recognize the generosity of our donors the foundations of Sharp HealthCare have three giving societies: Partners in Health, Pillars of Philanthropy and Legacy Circle.

Members of the Giving Societies of Sharp HealthCare include membership in Sharp’s Friend of the Foundation Program. Friends of the Foundation receive special benefits and personal attention by Foundation staff at all hospitals within the Sharp system. Marketing and Communication The Foundations of Sharp have partnered with Crescendo for several years for planned giving resources and our Legacy website. The Foundation also use Crescendo’s email marketing tools for legacy and planned gift newsletters and seminar and forum invitations. The Foundations have extensive relations with financial advisors in San Diego (at times organized as the Sharp Family of Advisors) who participate in educational seminars and forums and programs and provide referrals for planned gifts. Recognition At the recent Crescendo Practical Planned Giving Conference in San Diego. GiftLegacy Awards were presented at the opening luncheon. Congratulations to Sharp HealthCare Foundation as wereceived the coveted 2022 eMarketer of the Year Award. We were recognized for effectively using Crescendo’s GiftLegacy tools and services and in the last three years which helped us raise more than $63.5 million in gifts. Interview with Lily Shin, Associate Director of Gift Planning at Pitzer College Membership certainly has its privileges, one of which is to be involved with a wonderful community of seasoned professionals, eager to share of their professional lives with those coming into the field of gift planning. LACGP recently had the pleasure to hear from one of our newest members, Lily Shin, Associate Director of Gift Planning at Pitzer College in Claremont, CA. LACGP: Lily, thank you for sharing some time with us. Let’s get right to some of the pressing questions that others, I expect, are excited to learn about you. How did you learn about the Los Angeles Council of Charitable Gift Planners (LACGP)? Lily: When I fell into the world of advancement and was beginning my career in higher education, I attended the Western Regional Planned Giving Conference. I was introduced to LACGP at that time. After joining the team at Pitzer College, I was strongly encouraged to become a member of LACGP by our Assistant Vice President of Advancement Yulanda Davis-Quarrie. She is a strong advocate for acquiring knowledge and furthering education. LACGP: What would you like to gain from being a member of LACGP? Lily: As the Associate Director of Planned Giving at Pitzer College, I oversee our planned giving society and donors. I am looking forward to learning new strategies, how to further steward and engage our planned giving donors, as well as increasing the number and types of planned gifts at the college. LACGP: What is interesting to you about planned giving? a.) Do you have a particular passion in the field? Lily: As a child of immigrants and a first-generation four-year college graduate, I am a strong advocate of increasing the accessibility of higher education. Therefore, I have a strong passion of securing legacies and bringing them into fruition by aligning them to the college’s initiatives, especially scholarships. Furthermore, I enjoy meeting new people, creating authentic relationships, and helping match their philanthropic goals to the college. b.) What do you feel is the most important thing you can learn this year? Lily: The most important thing I can learn this year is continuing to learn how to create lasting authentic relationships with donors and continue to build a strong and robust planned giving program at our small college. c.) How can LACGP help you accomplish this year’s goals? Lily: I am eager to continue to attend LACGP seminars and network with the greater Los Angeles Gift Planning community to learn how to benefit both donors, the college, and our students! Lily Shin graduated from the University of California, San Diego with a degree in Human Development. She also earned a master’s in public administration from the University of Southern California. Lily currently holds the position of Associate Director of Gift Planning at Pitzer College in Claremont, CA – www.pitzer.edu. Previously, Lily was an Assistant Director of Planned Giving at USC. She enjoys spending her weekends with her husband Andy, and their four year-old son and twin one year-old girls. Register for the November General Meeting November 17, 2022 The Los Angeles Council of Charitable Gift Planners holds four General Meetings each year. Our General Meetings are like attending a half-day conference on gift planning. Attendees benefit from hearing two different presentations at either the beginner or advanced level. Come learn the latest concepts and techniques to help your donors or clients make planned gifts that meet their financial and philanthropic goals. Sessions may include facilitated breakouts so you can engage with your fellow attendees. Morning Session – Investing Donor Assets in 2022 and Beyond: Values Over Returns with David Hohler, CFA Advanced Case Study – DEI IDEA: Making Organizational Goals a Departmental Reality with Abigail Oduol, CFRE Members: $75 | Non-Members: $85 REGISTER HERE |

Sharp HealthCare, San Diego’s largest healthcare provider, is supported by three nonprofit, philanthropic foundations: Sharp HealthCare Foundation (SHF); Grossmont Hospital Foundation (GHF); and Coronado Hospital Foundation (CHF) (

Sharp HealthCare, San Diego’s largest healthcare provider, is supported by three nonprofit, philanthropic foundations: Sharp HealthCare Foundation (SHF); Grossmont Hospital Foundation (GHF); and Coronado Hospital Foundation (CHF) (